-

Xinqi Development Zone, Leliu, Foshan, Guangdong

PMMA Guide: Plastic Crystal Transforms Future Tech

Abstract

Acrylic (PMMA), known as “plastic crystal”, has become one of the core materials in modern industry and consumption due to its high transparency, weather resistance, plasticity and environmental protection. Based on authoritative data from the global and Chinese markets, this article systematically analyzes the market size, competition pattern and future trends of the acrylic industry in terms of technological innovation, application expansion and policy drive. Data shows that the global acrylic market size will reach US$26.33 billion in 2023, with the Chinese market accounting for more than 42.7%. It is estimated that the global acrylic board market size will exceed RMB 52.445 billion in 2029. From construction, automobiles to medical and scientific research, the cross-border application of acrylic continues to break through the boundaries of technology, and its intelligent, green and international development path will reshape the industry ecology.

I. Market size and growth: explosive expansion driven by global demand

The acrylic market has shown strong growth in recent years. In 2023, the global market size will reach 26.33 billion US dollars, of which the Chinese market will account for more than 42.7%, with a scale of about 25 billion yuan and an annual output of millions of tons. This growth is due to the diversified expansion of downstream application fields, such as the continued demand in the fields of construction, advertising, and medical care. It is estimated that by 2029, the global acrylic board market will reach 52.445 billion yuan, with a compound annual growth rate (CAGR) of 5.33%.

Data support:

- As the world’s largest producer, China’s acrylic production accounted for 48% of the world in 2021, reaching 430,000 tons.

- The construction field accounts for 40% of the consumption share, becoming a core growth point.

Second, diversification of application fields: comprehensive penetration from traditional to cutting-edge

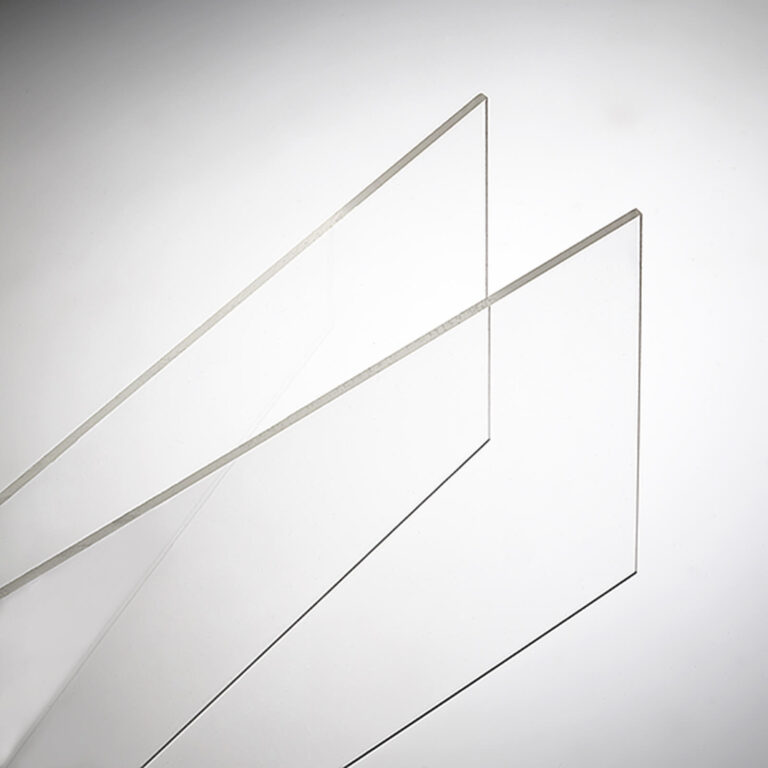

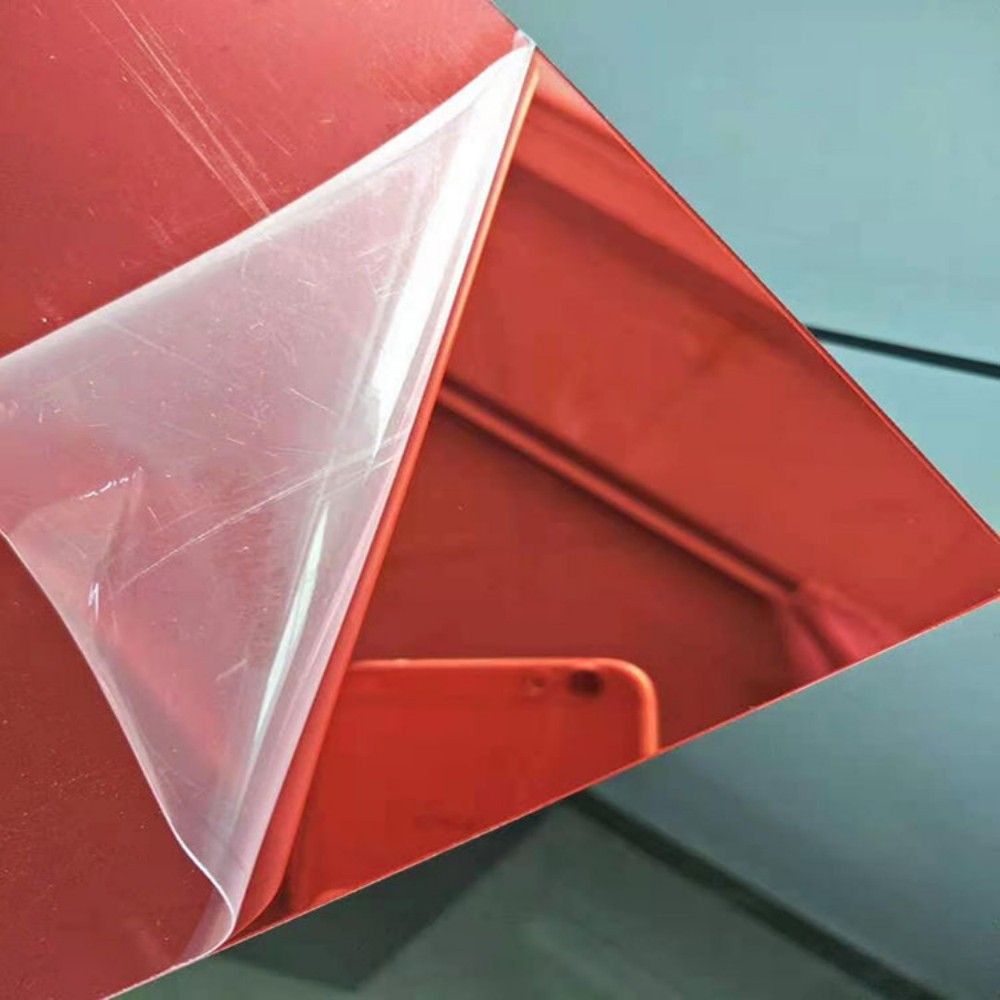

1. Architecture and decoration: the perfect combination of transparency and strength

Acrylic accounts for 30% of the application in the construction field, covering exterior walls, skylights, partitions, etc. Its light weight and high strength make it an ideal substitute for glass. For example, the acrylic gutter designed by Tomson Group for the Xiamen Bailu Stadium is 35mm thick and has both structural strength and aesthetic value.

2. Automobile and transportation: dual breakthroughs in lightweight and safety

Acrylic headlight covers, aircraft windows and other products are highly favored due to their impact resistance and anti-aging properties. The 6.1-meter curved window built by Tomson Technology for a Vietnamese luxury cruise ship is 100mm thick and weather-resistant to extreme marine environments.

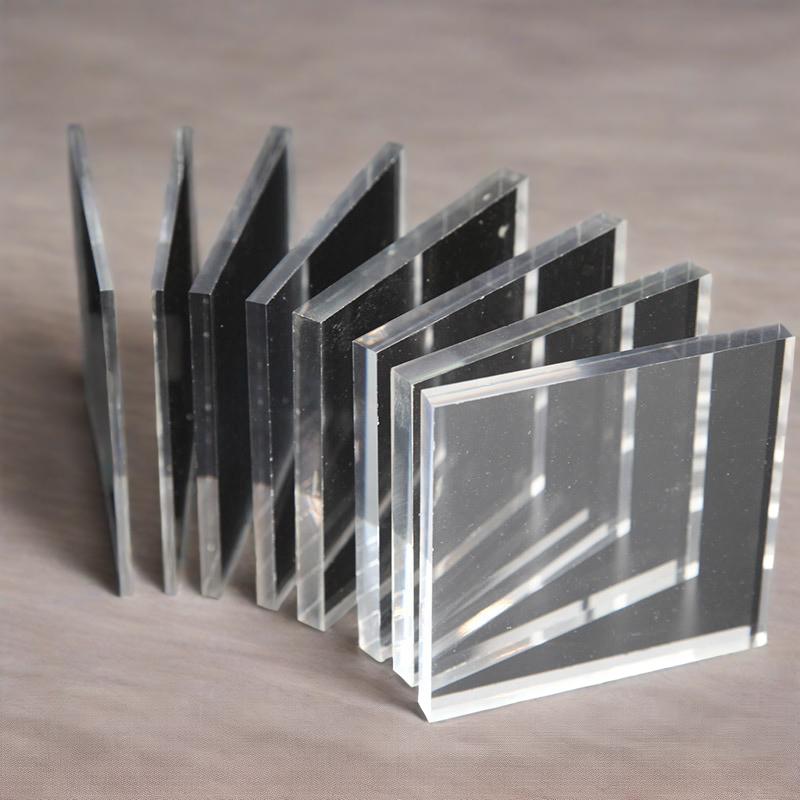

3. Medical and scientific research: precise application of high-purity materials

The medical field accounts for 10% of the market share, and acrylic is used for surgical instruments, corrective devices and high-end scientific research equipment. For example, the Jiangmen Neutrino Experiment Detector uses 263 acrylic plates produced by Tomson Technology, with a diameter of 35.4 meters, which is the world’s largest single organic glass ball.

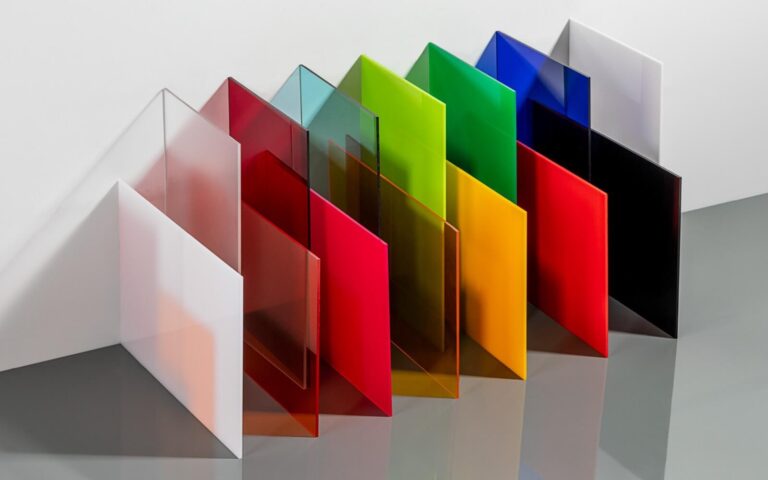

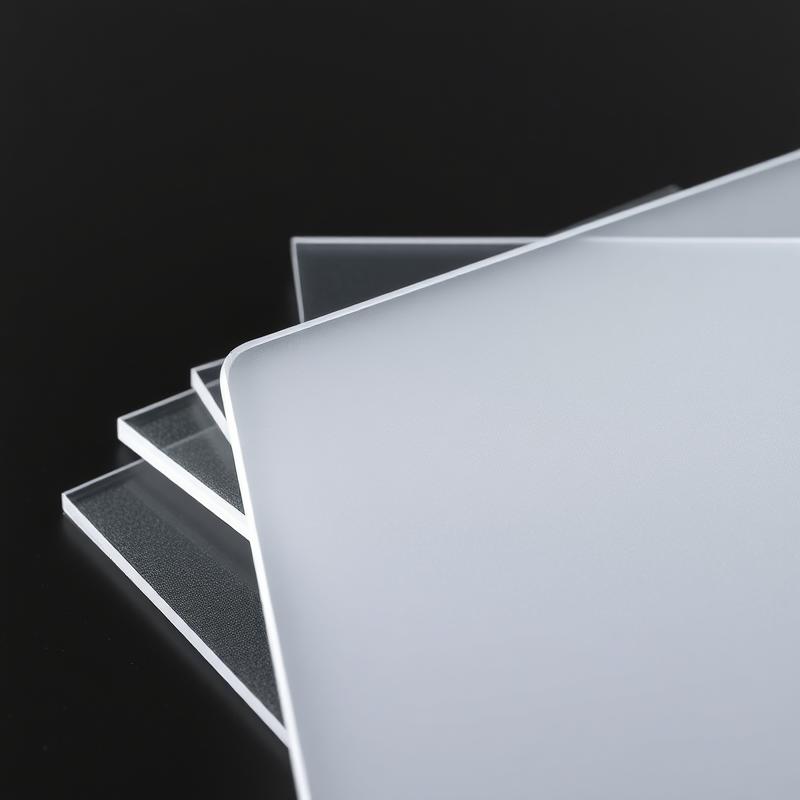

4. Electronics and optics: collaborative innovation of transparency and functionality

The application of acrylic in light guide plates and liquid crystal displays continues to grow. Its light transmittance reaches 92%, and its scratch resistance is improved through nanotechnology, making it the preferred material for high-end display devices.

III. Technological innovation: industrial upgrading driven by intelligence and new materials

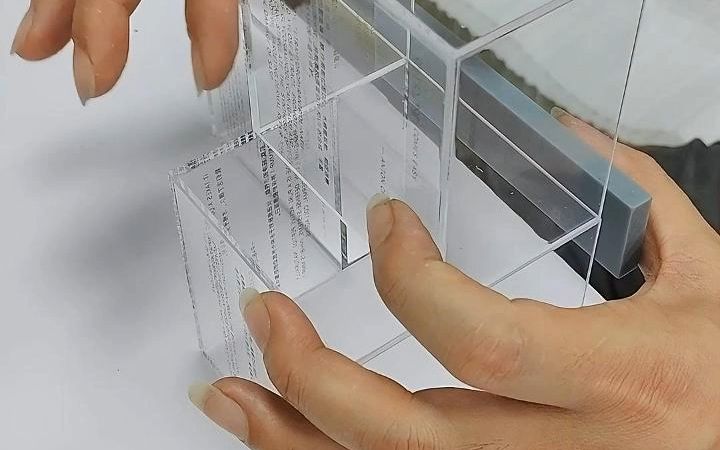

1. Intelligent production: from manual to “unmanned” assembly line

The traditional processing mode is transforming towards intelligence. For example, Tomson Group introduced five-axis engraving technology to create the acrylic mountain landscape of Taiyuan Station with millimeter-level accuracy. In the future, the central control system and robot collaboration will achieve full process automation.

2. New material research and development: both functionality and environmental protection

Through surface modification and composite material technology, the pollution resistance and flame retardancy of acrylic are significantly improved. The development of degradable acrylic materials has also become a trend, such as the application of recyclable PMMA in the packaging field.

IV. Environmental policy promotion: green production and sustainable development

Global environmental regulations are becoming stricter, driving the acrylic industry to transform towards a low-carbon direction. For example, the EU REACH regulations require materials to meet low VOC standards, forcing companies to optimize production processes. Under China’s “dual carbon” goal, Tomson Technology reduces energy consumption through bulk polymerization technology, and its products have passed the German TUV certification.

Case:

- Acrylic bathtubs replace traditional ceramics due to their recyclable properties, reducing carbon emissions by 30%.

V. Internationalization process: from local leaders to global competition

Chinese acrylic companies are accelerating their overseas layout. Head companies such as Diyak and Acrylic Bao have expanded their market share through mergers and acquisitions and cooperation, while Tomson Technology has participated in projects such as Paris Design Week and the Spanish Coral Kingdom to enhance its international brand influence. However, international trade barriers and differences in technical standards remain challenges, such as the EU’s environmental review of PMMA imports.

VI. Industry competition pattern: coexistence of head concentration and differentiation

China’s acrylic industry has a high degree of concentration, with the top five companies (such as Diyak and Tomson Technology) occupying 60% of the market share. International giants such as Mitsubishi Chemical and Arkema have seized the high-end market through technology monopoly and customized services, while small and medium-sized enterprises have focused on niche areas, such as medical-grade acrylic sheets.

VII. Future trends: personalized needs and cross-border integration

1. Customized services: precise matching in the Internet + era

Consumers’ demand for personalized home furnishings and art installations has surged. For example, Tomson Group supports college design competitions to promote the creative application of acrylic in the fields of art and furniture.

2. Cross-border integration: in-depth integration of materials and technology

The combination of acrylic with smart devices (such as foldable screens) and new energy (such as photovoltaic modules) has become a new direction. For example, the penetration rate of acrylic light guide plates in LED lighting has increased year by year.

VIII. Challenges and countermeasures: technical barriers and supply chain risks

Despite the broad prospects, the acrylic industry still faces challenges such as raw material fluctuations (such as MMA monomer prices) and technical barriers (such as high-end casting plate processes). Countermeasures include:

- Strengthen R&D investment: Tomson Technology cooperates with Tsinghua University to establish a research institute to overcome low-background material technology.

- Optimize the supply chain: Establish strategic cooperation with upstream suppliers to ensure a stable supply of MMA.

Summary

The acrylic industry is undergoing a transformation from “quantity” to “quality”, and technological innovation, environmental protection policies and global layout constitute its growth engine. In the future, with breakthroughs in intelligent production, degradable materials and cross-border applications, acrylic is expected to open up a market of hundreds of billions in the fields of medical care, new energy, etc. However, companies need to deal with technical barriers and supply chain risks, and only through collaborative innovation and green transformation can they take the lead in this material revolution.

Authoritative data sources:

- Global market size analysis: China Research Institute of Industry Research

- Tomson Technology Innovation Case: Bilibili Special Report

- Environmental protection policies and standards: German TUV Certification Official Website